Marshall University provides dental insurance through SunLife.

PROTECTS YOUR SMILE.

You can feel more confident with dental insurance that encourages routine cleanings and checkups. Dental insurance helps protect your teeth for a lifetime.

PREVENTS OTHER HEALTH ISSUES.

Just annual preventive care alone can help prevent other health issues such as heart disease and diabetes. Many plans cover preventive services at or near 100% to make it easy for you to use your dental benefits.

LOWERS OUT-OF-POCKET EXPENSES.

Seeing an in-network dentist can reduce your fees approximately 30% from their standard fees. Add the benefits of your coinsurance to that and things are looking good for your wallet.

Who is Eligible?

- All active benefit-eligible employees.

- Retirees – During the 90 days prior to your anticipated retirement date, you have two options;

- Meet with your Benefits Coordinator (BC) to discuss retiree benefits and complete your enrollment form.

- Contact FBMC for your retiree enrollment packet.

- Eligible dependent children – Eligible employees may cover your eligible dependent children to age 26, and spouses.

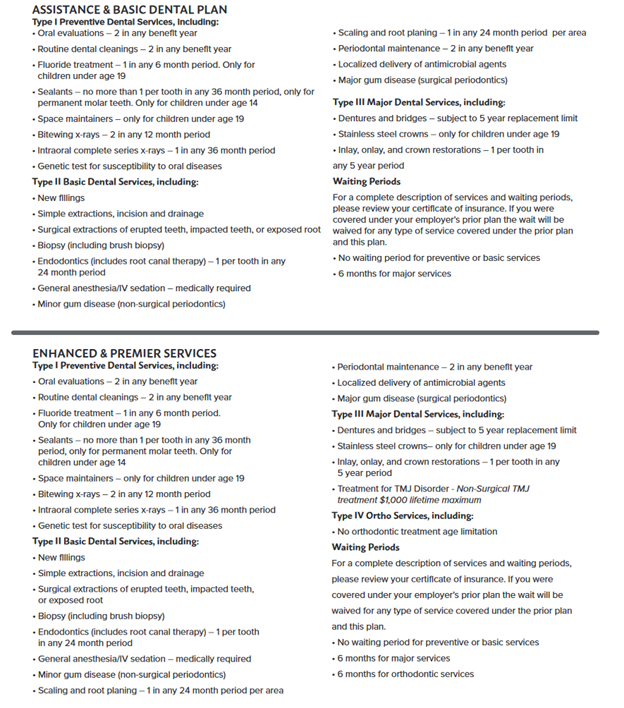

Assistance Plan – PPO Plan (Preferred Provider Organization)

You can see any doctor you choose, but you can save money when you stay in-network. Typically, your dentist will file claims for you and then you will pay your portion based on your plan.

Consider this plan if:

- You are concerned about the cost of maintaining your healthy smile

- You have any upcoming procedures that will require multiple visits to the dentist.

- Download plan summary (PDF)

Basic Plan – PPO Plan (Preferred Provider Organization)

You can see any doctor you choose, but you can save money when you stay in-network. Typically, your dentist will file claims for you and then you will pay your portion based on your plan.

Consider this plan if:

- You are concerned about the cost of maintaining your healthy smile

- You have any upcoming procedures that will require multiple visits to the dentist.

- Download plan summary (PDF)

Enhanced Plan – PPO Plan (Preferred Provider Organization)

You can see any doctor you choose, but you can save money when you stay in-network. Typically, your dentist will file claims for you and then you will pay your portion based on your plan.

Consider this plan if:

- You are concerned about the cost of maintaining your healthy smile

- You have any upcoming procedures that will require multiple visits to the dentist.

- Download plan summary (PDF)

Premier Plan – PPO Plan (Preferred Provider Organization)

You can see any doctor you choose, but you can save money when you stay in-network. Typically, your dentist will file claims for you and then you will pay your portion based on your plan.

Consider this plan if:

- You are concerned about the cost of maintaining your healthy smile

- You have any upcoming procedures that will require multiple visits to the dentist.

How to Enroll

- Online System at MyFBMC – Please Login

- For changes during open enrollment

- Electronic Form

- If you are not making any changes to your benefits, you do not need to complete an enrollment form.

Form Instructions

Remember to complete all requested information for your benefits.

- Sections 1, 2, and 3:

- Simply follow all the instructions and complete the information requested.

- For each benefit you are adding, changing or canceling, you must check the appropriate box next to the corresponding benefit.

- For the benefit selections you are not altering, check the “Keep Coverage” box. If you complete an enrollment form, but do not indicate your desire to cancel or change an existing benefit, that benefit will continue regardless of other benefits which may or may not be indicated on the enrollment form.

- Dental Care:

- Select a Sun Life plan. All employees and retirees are eligible to enroll in any Sun Life plan.

- Check the type of coverage you are choosing and enter the cost per-pay-period amount.

- Section 4:

- Active Employees – if you selected dependent coverage (child, spouse, family) you must complete this section. This includes the dependents’ names, relationship to you, birth dates and Social Security numbers. Use an additional sheet of paper as needed for additional dependents.

- Retirees – If you are selecting ‘Retiree & Children,’ ‘Retiree & Spouse,’ or ‘Retiree & Family’ coverage, you must complete the dependent information in the section.

- If your retirement date is after July 1, your Enrollment Form must be returned within 60 days of your retirement date. Your coverage will be effective the first day of the month following your retirement and you will be billed accordingly.

Sun Life

PO Box 1618

Milwaukee, WI 53201-1618

Sun Life

PO Box 1618

Milwaukee, WI 53201-1618

M-F 8am -8 pm Schedule a Benefit Counselor Appointment or chat