Marshall University employees are offered Short-Term and Long-Term Disability Insurance through the Standard and FBMC. It offers benefits-eligible employees the opportunity to have income replacement protection in the event of an accident or illness which results in the loss of pay. There is pre-existing condition exclusion. Total cost of the premium is paid by the employee. Enrollment for this plan is any time during the month of employment.

Long Term Disability

Long-term Disability (LTD) insurance can help safeguard your family’s lifestyle and provide some peace of mind in the event you become disabled and are unable to work.

When am I considered disabled?

During the benefit waiting period and the next 24 months you are considered disabled if, due to injury, physical disease, pregnancy or mental disorder, you are unable to perform with reasonable continuity the material duties of your own occupation, or you are unable to earn more than 80 percent of your pre-disability earnings while working in your own occupation.

Thereafter, you are considered disabled if, due to an injury, physical disease, pregnancy or mental disorder, you are unable to perform with reasonable continuity the material duties of any gainful occupation for which you are reasonably fitted by education, training and experience, or you are unable to earn more than 60 percent of your pre-disability earnings while working in your own or any other occupation.

There are two options for LTD

- FBMC Long-Term Disability

- The Standard Long-Term Disability

PLEASE NOTE: You MUST only select one Long-Term Disability option and not both.

FBMC Long-Term Disability

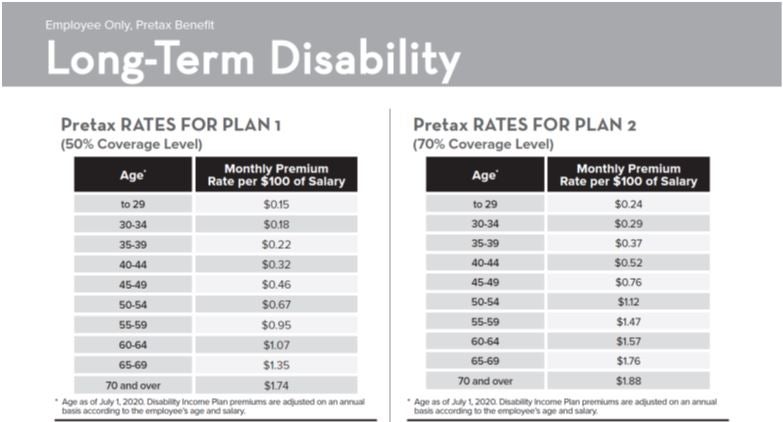

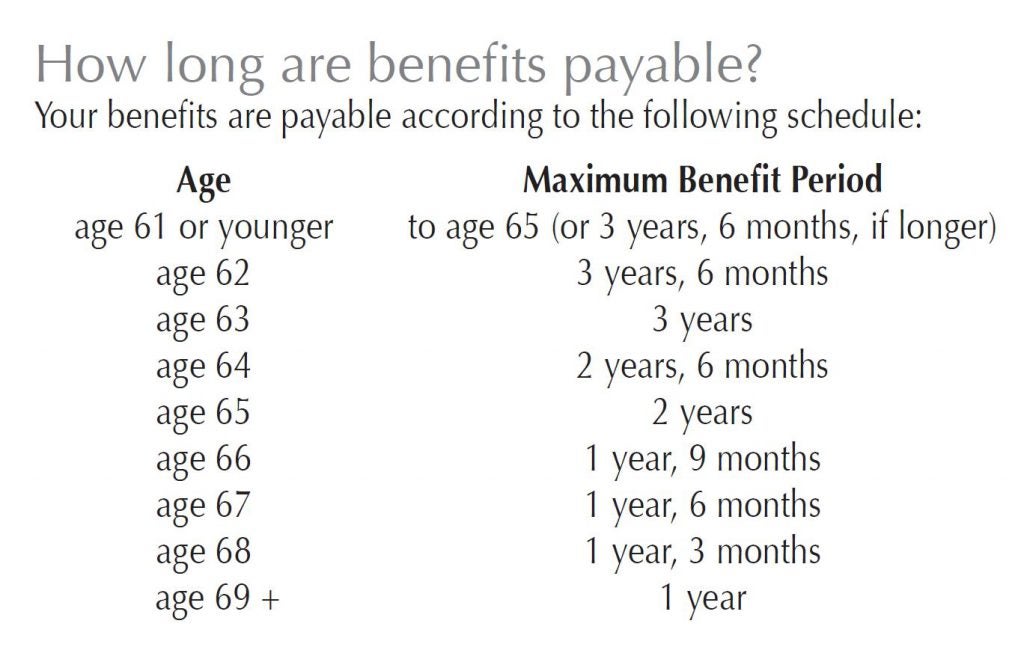

You may apply for coverage under either Plan 1 or Plan 2 (FBMC). The monthly benefit under each plan is determined as follows:

- Plan 1: 50 percent of the first $6,000 of your monthly pre-disability earnings, reduced by deductible income. The maximum monthly benefit is $3,000.

- Plan 2: 70 percent of the first $8,571 of your monthly pre-disabilityearnings, reduced by deductible income. The maximum monthly benefit is $6,000.

Both plans have a minimum monthly LTD benefit of $100.

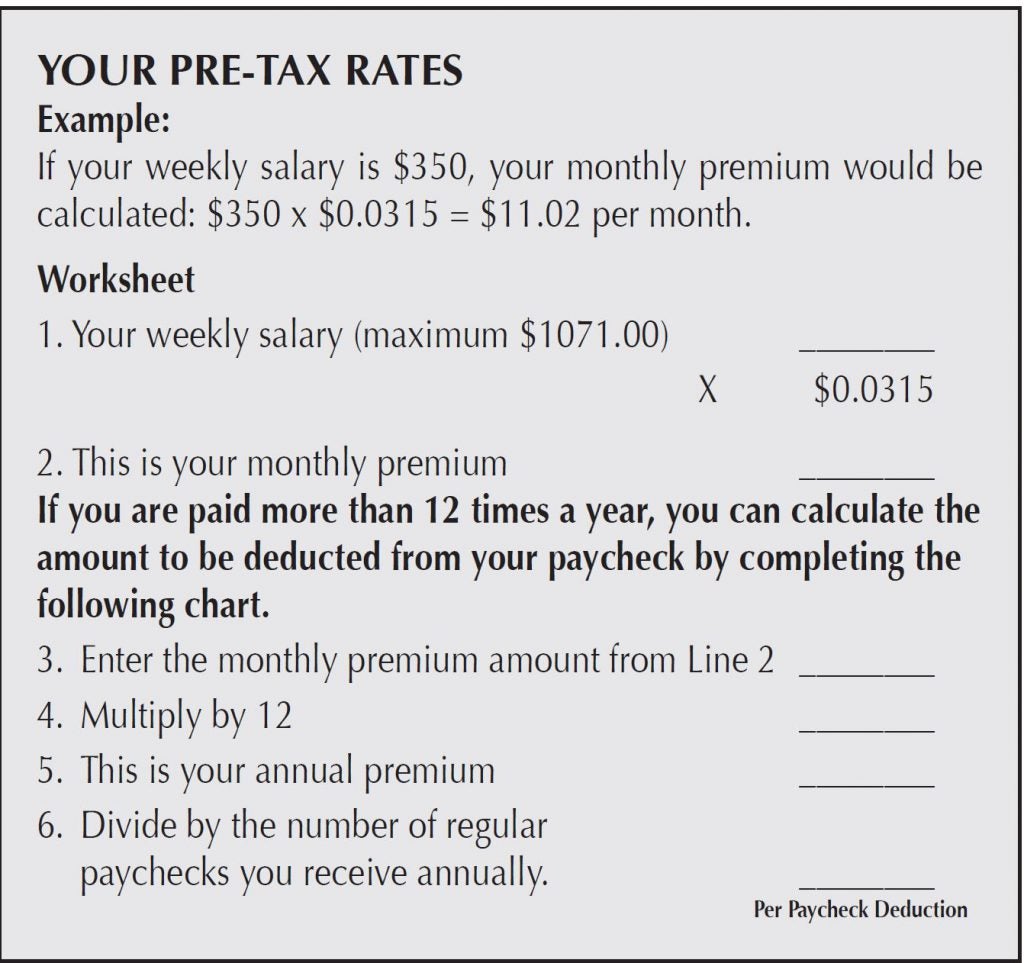

Pre-Tax Rates

- sick pay or other salary continuation

- workers’ compensation benefits

- Social Security benefits

- disability benefits from any other group insurance

- 50 percent of earnings from work activity while you are disabled (after the first 12 months of your disability)

- disability or retirement benefits you receive or are eligible to receive because of your disability under any state disability benefit law or similar law or your retirement plan.

You are not covered for a disability caused or contributed to by:

- a pre-existing condition (except as provided in your Certificate)

- an intentionally self-inflicted injury war

- any act of war.

Benefits are not payable for more than 24 months for each period of disability caused or contributed to by a mental disorder, or for any period when you are not under the ongoing care of a physician.

What is the definition of a pre-existing condition?

If your disability results, directly or indirectly, from a pre-existing sickness or injury for which you received medical treatment or services, took prescribed drugs or medicines, or consulted a Physician within three (3) months before the most recent effective date of your insurance, you will receive no monthly benefit for that condition. However, this exclusion does not apply to a period of Disability that begins after you have been insured under the plan for 12 consecutive months. The Pre-existing Condition Exclusion will apply to any added benefits or increases in benefits.

- Online System at www.myFBMC.comFor changes during open enrollment

- Paper Form

- New participants (Active or Retirees) who want to enroll for the first time

- Employees who need to update dependent information

- By paper form. Return your completed enrollment form to your Benefit Coordinator by the end of open enrollment

- If you are not making any changes to your benefits, you do not need to complete an enrollment form.

Form Instructions

Remember to complete all requested information for your benefits.

- Sections 1, 2, and 3:

- Simply follow all the instructions and complete the information requested.

- For each benefit you are adding, changing or canceling, you must check the appropriate box next to the corresponding benefit.

- For the benefit selections you are not altering, check the “Keep Coverage” box. If you complete an enrollment form, but do not indicate your desire to cancel or change an existing benefit, that benefit will continue regardless of other benefits which may or may not be indicated on the enrollment form.

- Disability Plan:

- Select the Disability Plan.

- Check the type of coverage you are choosing and enter the cost per-pay-period amount.

- Enrolling for the first time?

- Enroll online or complete an enrollment form and make your benefit selections by checking the “Add Coverage” box.

- Changing your benefits?

- Make changes online or complete an enrollment form and change your selections by checking the “Change Coverage” box. Complete the line with the new coverage information.

- Adding a new benefit?

- Enroll online or complete an enrollment form and make your selections by checking the “Add Coverage” box. Complete the line with the new coverage information.

- Keeping all of your current benefits?

- All benefits will continue as currently enrolled.

- Canceling current benefits?

- Make changes online or complete an enrollment form and check the “Cancel Coverage” box for the benefit you want to cancel; otherwise, it will automatically continue for the 2019 plan year.

- Transferring to a new agency?

- If you transfer from one agency to another, your benefits must remain the same.

- Complete an enrollment form, check the “Transfer” box and turn the form in to your new benefits coordinator.

- When an employee transfers, it is the employee’s responsibility to provide their current benefits to the new agency. In the event that the new employee is unsure of his or her current benefits, the employee needs to contact the old agency to confirm coverage.

- If an employee transfers from agency that did not participate to an agency that does participate, they will be treated as a “new hire.”

The Standard Long-Term Disability

Group Long Term Disability (LTD) insurance from Standard Insurance Company provides financial protection for eligible employees by promising to pay a percentage of monthly earnings in the event of a covered disability. The monthly income benefit payable is based on the amount of the employee’s monthly wage base.

Eligible Classes

- Class 1 – All eligible faculty employees

- Class 2 – All eligible non-faculty employees

- All active full-time employees of Marshall University and former employees of West Virginia Graduate College, who must work at least 20 hours a week to be considered full-time employee under the group policy. Except that if you are an otherwise eligible employee, you will not become ineligible for insurance by reason of a reduction in your schedule due to participation in your Employer’s Phased Retirement Program.

- The employee pays the cost of this coverage.

- Monthly Income Benefit

- 60 percent of monthly wage base paid by the employer, not to exceed a benefit of $5,000 a month, less the sum of benefits from other sources that apply to the same month (e.g., Social Security, workers’ compensation, state disability, etc.).

- In no event will the monthly income benefit be less than $100; or greater, 10 percent of the Monthly Income Benefit before benefits from other sources are subtracted.

- Monthly Annuity Premium Benefit

- Continues contributions to the employee’s TIAA-CREF retirement annuity while receiving monthly income benefits.

- The amount of the monthly annuity premium benefit is equal to 12 percent of the employee’s monthly wage base.

- Class 1

- 3 months or any period the employee is eligible to receive payments in each calendar month equal to their full monthly wage base under the employer’s short term disability plan or under the employer’s sick leave or salary continuation program.

- Class 2

- 6 months or any period the employee is eligible to receive payments in each calendar month equal to their full monthly wage base under the employer’s short term disability plan or under the employer’s sick leave or salary continuation program.

- Complete the enrollment form and return it to your Benefits Coordinator.

Short Term Disability

FBMC Short-Term Disability

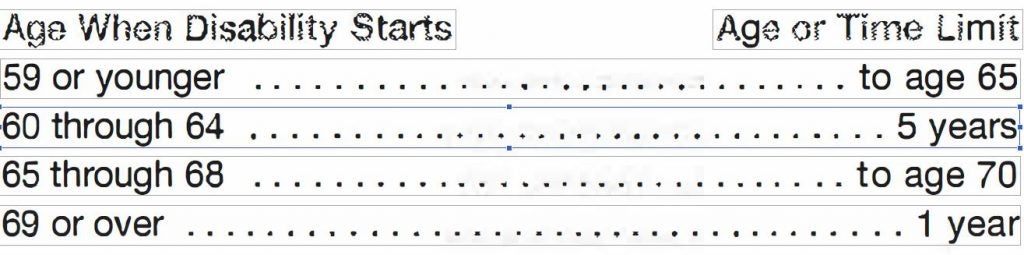

Short-Term Disability is the weekly benefit based on your earnings. The group insurance policy refers to these earnings as pre-disability earnings. The weekly benefit is 70 percent of your pre-disability earnings, reduced by deductible income.

- The maximum weekly benefit is $750

- The minimum weekly benefit is $15

- a work-related injury,

- an intentionally self-inflicted injury or

- war or any act of war.

Benefits are not payable for any period when you:

- receive or are eligible to receive sick leave,

- are working for any employer other than the State of West Virginia or Marshall

- are eligible for any benefits under a workers’ compensation act or

similar law or - are not under the ongoing care of a physician.

- Online System at www.myFBMC.com

- For changes during open enrollment

- Paper Form

- New participants (Active or Retirees) who want to enroll for the first time

- Employees who need to update dependent information

- By paper form. Return your completed enrollment form to your Benefit Coordinator by the end of open enrollment

- If you are not making any changes to your benefits, you do not need to complete an enrollment form.

Form Instructions

Remember to complete all requested information for your benefits.

- Sections 1, 2, and 3:

- Simply follow all the instructions and complete the information requested.

- For each benefit you are adding, changing or canceling, you must check the appropriate box next to the corresponding benefit.

- For the benefit selections you are not altering, check the “Keep Coverage” box. If you complete an enrollment form, but do not indicate your desire to cancel or change an existing benefit, that benefit will continue regardless of other benefits which may or may not be indicated on the enrollment form.

- Disability Plan:

- Select the Disability Plan.

- Check the type of coverage you are choosing and enter the cost per-pay-period amount.

- Enrolling for the first time?

- Enroll online or complete an enrollment form and make your benefit selections by checking the “Add Coverage” box.

- Changing your benefits?

- Make changes online or complete an enrollment form and change your selections by checking the “Change Coverage” box. Complete the line with the new coverage information.

- Adding a new benefit?

- Enroll online or complete an enrollment form and make your selections by checking the “Add Coverage” box. Complete the line with the new coverage information.

- Keeping all of your current benefits?

- All benefits will continue as currently enrolled.

- Canceling current benefits?

- Make changes online or complete an enrollment form and check the “Cancel Coverage” box for the benefit you want to cancel; otherwise, it will automatically continue for the 2019 plan year.

- Transferring to a new agency?

- If you transfer from one agency to another, your benefits must remain the same.

- Complete an enrollment form, check the “Transfer” box and turn the form in to your new benefits coordinator.

- When an employee transfers, it is the employee’s responsibility to provide their current benefits to the new agency. In the event that the new employee is unsure of his or her current benefits, the employee needs to contact the old agency to confirm coverage.

- If an employee transfers from agency that did not participate to an agency that does participate, they will be treated as a “new hire.”