What is a Health Savings Account?

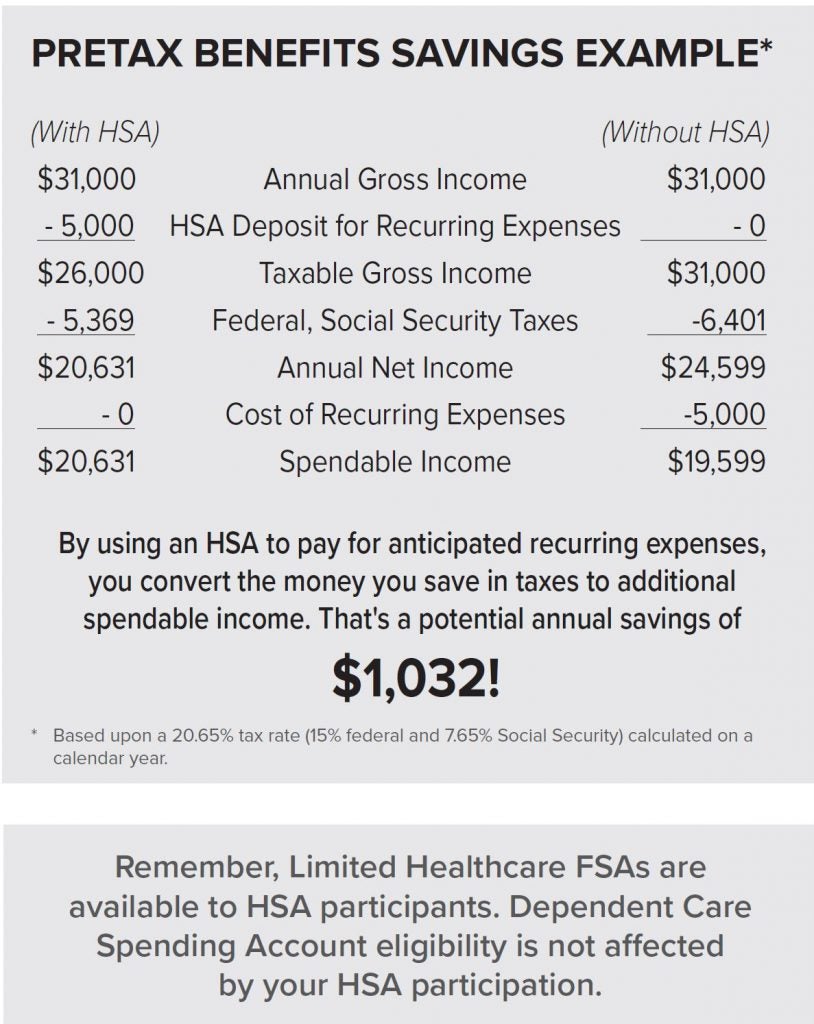

Providing economical Healthcare while costs are rising is a major issue. To deal with this issue and help you plan for future health expenses, you will have the choice of enrolling in a Health Savings Account (HSA) or Limited Healthcare (FSA) . This option allows you and your family to take greater responsibility for your medical care to reduce your insurance premiums and save money for  future health expenses.

future health expenses.

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-free account that can be used to pay Healthcare expenses. Unlike money in a Flexible Spending Account, the funds do not have to be spent in the plan year they are deposited. Money in the account, including interest or investment earnings, accumulates tax-free, so the funds can be used to pay qualified medical expenses in the future. An important advantage of an HSA is that it is owned by the employee. If you leave your job, you can take the account with you and continue to use it for qualified medical expenses.If you enroll in a Health Savings account, you cannot enroll in a Health Care Flexible Spending Account, but may enroll in a Limited Health Care Spending Account.

West Virginia public higher education employees now have the option of selecting one of two Health Savings Account vendors. See resources on both options.

- TIAA Health Equity – NEW FOR 2022 – TIAA is working with HealthEquity to provide an integrated, online HSA experience. HSA funds are held in one of two cash account options offered by HealthEquity. Once your balance in the cash account is $1,000 or more, you can allocate to a diversified menu of mutual funds.

- Mountaineer Flexible Benefits (FBMC) in partnership with PayFlex

- You are covered under a high deductible health plan (HDHP), which for public higher education employees means PEIA PPB Plan C

- You have no other health coverage

- You aren’t enrolled in Medicare

- You are not claimed as a dependent on someone else’s tax return

- Single Coverage may contribute up to $3,850 per year.

- Family Coverage may contribute up to $7,750 per year

- Over age 55 may make additional $1000 “catch-up” contributions per year.

Health Equity:

- TIAA will work with Marshall to automatically set up your account and supply a TIAA HSA administered by HealthEquity® Visa® Health Account Card1 so that you can conveniently pay for eligible expenses.

- Add money to your HSA Fund your HSA through pre-tax payroll deductions or transfer money into your account through the HealthEquity member portal. Watch your HSA grow. Your HSA earns tax-free interest. You can also maximize your tax-free earning potential by investing your HSA into our standard investment menu of TIAA-CREF and other mutual funds.

HSA with Payflex:

- After electing the HSA, your information and account is established. Please go to payflex.com to open your account. You will receive a MasterCard with instructions on how to go to payflex.com and create your profile. You can link your bank account and set up for alerts. You may order additional cards at no charge online or by calling customer service at 844- 729-3539.

- You may use your MasterCard to pay for eligible expenses. However, if you withdraw funds for ineligible expenses, you may have to pay taxes and penalties on those funds, unless you reimburse your HSA for the ineligible expense.

With Payflex, The custodian will charge you $2.50 per month for your HSA. This fee includes the MasterCard® debit card, all transaction fees associated with the card. To make an HSA payment, use the online payment tool to pay your provider directly from your HSA. A check will be mailed to your provider at no additional cost. Other fees may apply, including fees for insufficient funds and account closure fees. Refer to the PayFlex Fees and Charges for more information.

Limited Healthcare FSA

A Limited Healthcare FSA (LPFSA) is offered in conjunction with your Health Savings Account, should you elect. LPFSA funds can only be used for dental and vision. You are not allowed to contribute to both a health savings account as well as a standard (non-limited) healthcare FSA.

- Your LPFSA may be used to reimburse eligible expenses incurred by yourself, your spouse, your qualifying child or your qualifying relative.

Minimum – $150

Maximum – $3,050

- Funds are available on day one of the plan. Once you sign up for a LPFSA and decide how much to contribute, the maximum annual amount of reimbursement for eligible expenses will be available throughout your period of coverage. Since you don’t have to wait for the cash to accumulate in your account, you can use it to pay for your eligible expenses at the start of your plan year.

Enrollment

How to Enroll

- Online System at MyFBMC – Please Login For changes during open enrollment

- Health Equity Enrollment Form

- If you are not making any changes to your benefits, you do not need to complete an enrollment form.

Form Instructions -Remember to complete all requested information for your benefits.

- Sections 1, 2, and 3:

- Simply follow all the instructions and complete the information requested.

- For each benefit you are adding, changing or canceling, you must check the appropriate box next to the corresponding benefit.

- For the benefit selections you are not altering, check the “Keep Coverage” box. If you complete an enrollment form, but do not indicate your desire to cancel or change an existing benefit, that benefit will continue regardless of other benefits which may or may not be indicated on the enrollment form.

- Health Savings Account:

- Select your HSA coverage type:

- Complete Boxes 1, 2, and 3

- If you are selecting Limited Healthcare FSA, complete those boxes also.

- * Remember, for the Limited FSA, you must be enrolled in an HSA.

- Complete the subtotal boxes.

Reminder – If you enroll in a Health Savings account, you cannot enroll in a Health Care Flexible Spending Account, but may enroll in a Limited Health Care Spending Account.

- Enrolling for the first time?

- Enroll online or complete an enrollment form and make your benefit selections by checking the “Add Coverage” box.

- Changing your benefits?

- Make changes online or complete an enrollment form and change your selections by checking the “Change Coverage” box. Complete the line with the new coverage information.

- Adding a new benefit?

- Enroll online or complete an enrollment form and make your selections by checking the “Add Coverage” box. Complete the line with the new coverage information.

- Keeping all of your current benefits?

- All benefits will continue as currently enrolled.

- Canceling current benefits?

- Make changes online or complete an enrollment form and check the “Cancel Coverage” box for the benefit you want to cancel; otherwise, it will automatically continue for the 2019 plan year.

- Transferring to a new agency?

- If you transfer from one agency to another, your benefits must remain the same.

- Complete an enrollment form, check the “Transfer” box and turn the form in to your new benefits coordinator.

- When an employee transfers, it is the employee’s responsibility to provide their current benefits to the new agency. In the event that the new employee is unsure of his or her current benefits, the employee needs to contact the old agency to confirm coverage.

- If an employee transfers from agency that did not participate to an agency that does participate, they will be treated as a “new hire.”